Secton 12J

What is section 12J / Benefits of 12J investing?

Who knew you could reduce your tax liability and grow your wealth at the same time? Well SARS does provide a solution, being, Section 12J legislation.

How does this work?

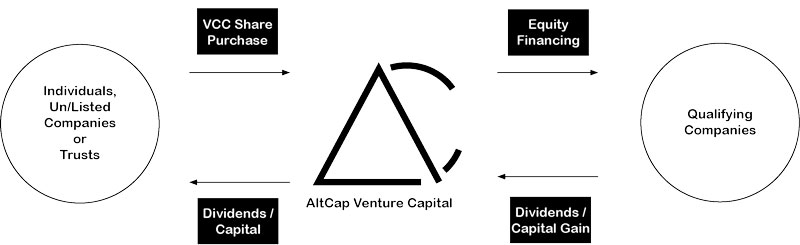

The below diagram explains simply the flow of investing into a registered section 12J company.

- Taxpayers invest into AltCap Venture Capital (Pty) Ltd through an acquisition of venture capital company (VCC) shares. This entitles the taxpayer to a 100% tax deduction in the following year of assessment. (AltCap issues the investor with a share certificate)

- AltCap, in turn, acquire shares in underlying qualifying companies. Qualifying companies meaning high return, high growth companies who require medium to long term funding requirement.

- The qualifying companies generate a return, which is distributed back to shareholders.

- AltCap distributes a portion of the returns as a dividend, and retains capital for future investment opportunities.

Tax Saving

By investing in AltCap you are entitled to a 100% tax deduction on the monies invested. Depending on your marginal tax rate, this grants an investor an immediate return of up to 45% for individuals and 28% for companies.

You might think this is too good to be true, however, the main aim of the Section 12J legislation was to promote funding for small and medium sized enterprises (SMEs), in turn this funding provided stimulates economic growth as well as job creation.

The Nitty Gritty of Section 12J

AltCap has to meet certain requirements in order to maintain its section 12J venture capital status. Any investment made by AltCap has to be pure equity, and we may not acquire more than 69% of shares in any qualifying company.

AltCap may not invest in the following companies

- Immovable property

- Banking

- Long and Short-term insurance

- Money lending

- Hire-purchase funding

- Financial or advisory services

- Legal services

- Stock broking services

- Management consulting services

- Tax advisory services

- Auditing or accounting services

- Gambling

- Liquor

- Tobacco

- Arms or ammunition

- Trade carried on mainly outside South Africa

With regards to monies received from investors, 80% of monies need to be deployed by acquiring shares in qualifying companies within 3 years. Directly after AltCap invests in a qualifying company, the book value of the qualifying company has to be less than 50 million rand.

No investment made by AltCap into a qualifying company may exceed more than 20% of the total fund value. The requirement also applies to investors - no investor may make up more than 20% of the AltCap fund.

No tax deduction will be granted if, directly after the investment in AltCap, the tax payer becomes a connected person in relation to AltCap.

As per section 12J (3A) a connected person means:

|

Natural person |

In relation to a: |

Requirements: |

| Natural person | Any relative | |

| Trust | Any trust if the natural person or relative is a beneficiary of the trust | |

| Company | Individually or jointly, with any connected person, holds directly or indirectly at least 20% of the Equity Shares and Voting Rights | |

|

Company |

In relation to a: |

Requirements: |

| Company | If at least 20% of both equity shares and voting rights are held by the company, and no shareholder has majority voting rights. |

If we, as AltCap, do not comply with the above-mentioned provisions of both the income tax act as well as the 12J provision, AltCap will be fined 125% of all expenditure incurred by the taxpayers in acquiring AltCap shares.

Extra Links

-

Tax Savings - Financial Year End

The S12J has been increasing in popularity over the last 2 years, with only 30 registered funds as at the beginning of the 2015 tax, compared to over 120 at the soon approaching end of the 2017 tax...

-

AltCap, renamed BitCap

There was a strategic decision to rename AltCap to Bitcap, just for today’s newsletter...

-

AltCap Section 12J Intro

Deton Private Wealth would like to welcome you to the first AltCap Venture Capital (PTY) LTD, a divisision of Deton Private Wealth, Newsletter...

-

Invest12J/Information

Some guides, articles, interviews and other resources related to Section 12J investments...

-

Invest12J

The complete guide to Section 12J Investments...

-

Moneyweb/Investing

Broadening your investment universe....

-

Moneyweb/Financial Advisors View

Stretching your pension investments....